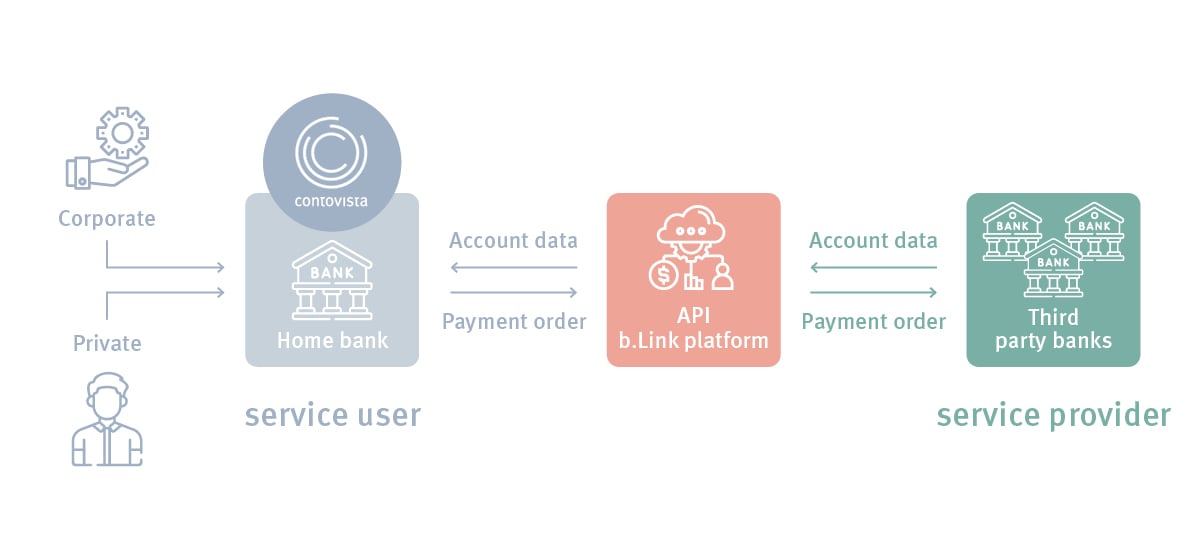

bLink enables high-performance Open Banking, while the participants form the necessary ecosystem. Yet for multibanking to be a future-oriented winning formula, a crucial ingredient is still missing: the integration of next-gen features that enable customers and banks alike to realise the additional benefits of Open Banking in the first place. Contovista’s multibanking module is based on the Business Finance Manager (BFM), which provides exactly such features.

The Smart Financial Cockpit for business customers provides customers with advanced liquidity planning, cash flow forecasting, and valuable real-time insights across all accounts. At the same time, third-party account insights create a more comprehensive data basis for banks, which they can use to make more tailored product offerings. These capabilities are enabled by powerful analytics and AI technologies in the background.

Further functions will be added continuously in the future in an automated manner. By adopting a technology-agnostic approach, customers and banks don’t have to deal with updates or standards: innovation is already on board with Contovista’s multibanking module.